04.08.2024/35

7524 sayılı Kanunla Vergi Usul Kanunu’nda Yapılan Düzenlemeler

7524 sayılı Vergi Kanunları ile Bazı Kanunlarda ve 375 Sayılı Kanun Hükmünde Kararnamede Değişiklik Yapılmasına Dair Kanun 02.08.2024 tarih ve 32620 sayılı Resmi Gazete’de yayımlandı.

Söz konusu Kanun ile getirilen Vergi Usul Vergisi Kanunu’na ilişkin düzenlemeler aşağıda özetlenmiştir:

1. Sahte Belge Düzenlemek Amacıyla Mükellefiyet Tesis Ettirildiği Tespit Edilip Mükellefiyeti Terkin Edilenlerden Aranılacak Teminat Uygulamasında Değişikliğe Gidilmiştir.

Vergi Usul Kanununun 153/A maddesinde sahte belge düzenlemek amacıyla mükellefiyet tesis ettirildiği tespit edilip mükellefiyeti terkin edilenlerin yeniden mükellefiyet tesis ettirmek istemeleri yahut işe başlama bildiriminde bulunmaları durumunda bu mükelleflerden düzenlenmiş sahte belge tutarının %10’u nispetinde teminat aranmaktadır.

7524 sayılı Kanunla yapılan değişiklikle konuya ilişkin Anayasa Mahkemesinin madde ile ilgili verdiği karar doğrultusunda alınacak teminat tutarı 10 milyon Türk Lirası ile sınırlanmaktadır.

Bunun yanında teminatın verilme süresi otuz günden altmış güne çıkarılmıştır.

Son olarak teminat yükümlülüğünü yerine getirin ve mevcut statülerinin kaldırılması hususunda yasal girişim başlatan mükelleflerin borçların takibine ilişkin müşterek ve müteselsil sorumlulukları bulunmayacaktır.

Yürürlük: 02.08.2024

2. Elektronik Ticaret Yanında Diğer Dijital Ortamlarda Hizmet Sağlayanlara da Bildirim Yükümlülüğü Getirilebilmesine ve Mükellef Olmayanların da Tahsilat ve Ödemelerini Tevsik Zorunluluğu Kapsamına Almaya İlişkin Hazine ve Maliye Bakanlığına Yetki Verilmiştir.

Vergi Usul Kanununun mükerrer 257’nic maddesinde Hazine ve Maliye Bakanlığına çeşitli bildirim yükümlülükleri getirme konusunda yetki verilmektedir.

7524 sayılı Kanunla bu yetki, elektronik ticaret yanında her türlü dijital ortamında yapılan alım, satım, kiralama, ilan ve reklam gibi iktisadi ve ticari faaliyette bulunanlara, elektronik ticaret aracı hizmet sağlayıcılara vb. bildirim yükümlülüğü getirilebilmesine ilişkin olarak genişletilmiştir.

Diğer taraftan, mezkur düzenleme ile vergi mükellefiyeti bulunmayanların da tahsilat ve ödemelerini tevsik zorunluluğu kapsamına almaya ilişkin Hazine ve Maliye Bakanlığına yetki verilmiştir.

Yürürlük: 02.08.2024

3. Kıymetli Madenlerin Değerlemesinde Borsa Rayici Kullanılacaktır.

Kıymetli madenler emtia olarak kabul edildiğinden alış bedeli ile değerlenmekteydi. Dolayısıyla bu varlıklar için dönem sonu değerlemesi sonucu bir gelir veya gider oluşmamaktaydı.

7524 sayılı Kanunla VUK’un 263’üncü maddesinde yapılan değişiklikle kıymetli madenler borsasında işlem gören kıymetli madenlerin değerlemesinde borsa rayici kullanılacaktır.

Buna paralel olarak mezkur Kanun’a 274/A maddesi eklenmiştir. Madde hükmüne göre altın, gümüş, platin ve paladyum gibi kıymetli madenler borsa rayici ile değerlenecek, borsa rayici yoksa veya borsa rayicinin muvazaalı bir şekilde oluştuğu anlaşılırsa değerlemeye esas bedel olarak, bu rayiç yerine maliyet bedeli esas alınacaktır.

Kıymetli maden ile olan mevduat veya kredi sözleşmelerine müstenit alacaklar ve borçlar değerleme gününe kadar hesaplanacak faizleriyle birlikte dikkate alınacaktır.

Yürürlük: 02.08.2024

4. Kayıt Dışı Çalışanlara Kesilecek Vergi Ziyaı Cezası %50 Artırımlı Uygulanacaktır.

Vergi Usul Kanununun 344’üncü maddesinde vergi ziyaı cezası düzenlenmektedir. 7524 sayılı Kanunla maddede yapılan değişiklikle mükellefiyet tesis ettirilmesi gerektiği halde bu zorunluluğa uyulmaksızın vergi dairesinin ıttılaı dışında ticari, zirai veya mesleki faaliyette bulunmak suretiyle vergi ziyaına sebebiyet verilmesi halinde %50 artırımlı uygulanacaktır.

Yürürlük: 02.08.2024

5. Usulsüzlük Cezaları Artırılmıştır.

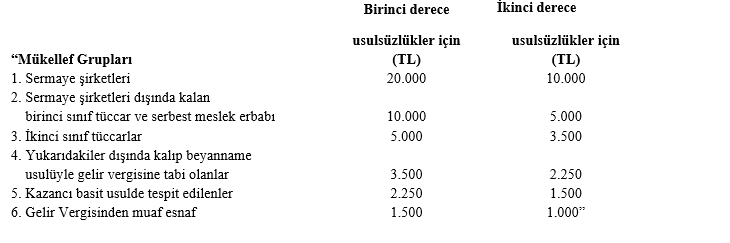

VUK’un 352’nci maddesinde vergi kanunlarının şekle ve usule müteallik hükümlerine riayet edilmemesi sebebiyle uygulanacak usulsüzlük cezalarının mükellefler itibariyele tutarları belirlenmektedir.

7524 sayılı Kanunla yapılan değişiklikle yeni usulsüzlük cezaları aşağıdaki şekilde belirlenmiştir:

Yürürlük: 02.08.2024

6. Özel Usulsüzlük Cezaları Artırılmış ve Kapsamına Yeni Fiiller Eklenmiştir.

VUK’un 353’üncü maddesinde düzenlenen özel usulsüzlük cezaları da 7524 sayılı Kanunla önemli ölçüde artırıldı. Bunun yanında mükerrer 355’inci madde kapsamındaki özel usulsüzlük cezaları da artırılmıştır.

Diğer taraftan, mükelleflerin mal teslimi veya hizmet ifalarına ilişkin tahsilatlarının, kendi adına kayıtlı hesaplar yerine, başka kişiler adına kayıtlı hesaplar aracılığıyla yapılması durumunda özel usulsüzlük cezası ile cezalandırlmalarını öngören düzenleme madde metnine eklenmiştir.

VUK’un mükerrer 355’inci maddesinde yapılan değişiklerle ise 153/A maddesinde yer alan teminat düzenlemelerine uyulmaması özel usulsüzlük cezası kapsamına alınmıştır.

Mükerrer 355’inci maddeye eklenen kapsamlı bent ile ödeme kaydedici cihaz üreticisi veya ithalatçıları ile bu cihazlara ilişkin hizmet veren güvenli servis sağlayıcıları, bankalar, elektronik para kuruluşları, ödeme kuruluşları, şarj ağı işletme lisansı sahipleri ve elektronik defter, belge ve kayıtların oluşturulması, imzalanması, iletilmesi ve saklanması hususlarından herhangi biri için hizmet verme konusunda yetkilendirilenler ile sipariş, satış, muhasebe, stok takip ve benzeri programları kullandıran, teslim eden veya satan mükelleflerin belirlenen yükümlülüklere uymamaları durumunda haklarında belirlenen tutarda özel usulsüzlük cezası uygulanmasına ilişkin düzenleme yapılmıştır.

Yürürlük: 02.08.2024

7. Vergi Aslı Uzlaşma Kapsamından Çıkartılmıştır.

Kanunun yayımından önceki başvurular hariç olmak üzere 7524 sayılı Kanunla yapılan değişiklikle vergi aslı uzlaşma kapsamından çıkartılmıştır. Buna göre Kanunun yürürlük tarihinden sonra yapılan başvurularda uzlaşma ancak vergi cezaları hakkında uygulanabilecektir.

Yürürlük: 02.08.2024

İlgili Kanuna buradan ulaşabilirsiniz.

Saygılarımızla,

BİLGENER