Investment Obligation of R&D and Design Centers

Article 3, paragraph fourteen of Law No. 5746 is as follows

is regulated.

“As of 1/1/2022, three percent of this amount shall be transferred to a temporary account in liabilities by corporate taxpayers whose discount amount utilized over the annual declaration within the scope of Article 3 within the scope of Article 3 is 2.000.000 Turkish lira and above. The amount to be transferred under this paragraph is limited to TL 100,000,000 on an annual basis. This amount shall be transferred to the temporary account until the end of the year in which the temporary account is established, provided that the shares of venture capital investment funds established to invest in entrepreneurs residing in Turkey are purchased or capitalized to entrepreneurs operating in venture capital investment trusts or incubation centers within the scope of Law No. 4691. If the said amount is not transferred until the end of the relevant year, twenty percent of the amount deducted on the annual declaration within the scope of this Law cannot be subject to the R&D discount utilized in the relevant year. Taxes not collected on time due to this amount shall be levied without applying tax loss penalty. The President may adjust the amounts and rates in this paragraph together or separately.

to zero and increase it up to five times. The procedures and principles regarding the implementation of this paragraph shall be determined by regulation.”

Pursuant to the aforementioned article of the Law, over the annual corporate tax declaration

3% of the deducted amount is subject to investment liability.

Detailed explanations regarding this obligation are set out below. ¹

1- Within the scope of Law No. 5746 for the formation of the investment obligation in question

The amount of R&D and design allowance subject to deduction is TRY 2.000.000 and above.

must be. Amount subject to deduction in the relevant year declaration 2.000.000 TL

below, no investment obligation will arise. Due to lack of earnings

The amount that cannot be deducted in the corporate tax return is deducted in the year in which it is made.

amount will be taken into account.

2- The amount of the investment obligation shall be taken into account in the annual declaration in accordance with Law No. 5746.

is equal to 3% of the R&D and design allowance amount utilized within the scope of the R&D and design allowance.

However, the amount obligation to be transferred is between TL 100.000.000 and

limited.

3- This 3% portion is transferred to a temporary account in the liabilities and is recognized in the year in which the temporary account is established.

investment is essential until the end.

4- The venture established to invest in entrepreneurs resident in Turkey

acquisition of venture capital investment fund shares or venture capital investment fund shares

partnerships or incubation centers within the scope of Law No. 4691

to be put as capital to the entrepreneurs.

5- In the event that the said amount is not transferred until the end of the relevant year, the amount numbered 5746

The amount deducted from the annual declaration within the scope of the Law

20% cannot be subject to the R&D and design discount utilized in the relevant year. This amount

Taxes not collected on time due to tax loss penalties are assessed without applying tax loss penalty.

shall be applied.

6- If the taxpayers within the scope of this regulation meet the conditions, 5520

Law No. 10/1-g and provisional article 4 of Law No. 4691 and Law No. 5520

An obstacle to benefit from the advantages specified in Article 5/1-a of the Law

is not available.

Example: Different corporate income of (A) Ltd. Şti. which owns R&D/Design Center

investment obligation in 2023 is calculated as follows.

Here is the translation of the provided table into English while preserving the HTML structure:

| Situation | Situation | |

| 2023 Corporate Profit (A) | 3,000,000 (Profit) | -1,000,000 (Loss) |

| 2023 R&D and Design Discount (B) | 1,500,000 | 1,500,000 |

| R&D and Design Discount Carried Over from Previous Year (C) | 500,000 | 500,000 |

| Total R&D and Design Discount Subject to Deduction in 2022 (D) | 2,000,000 | – |

| R&D and Design Discount Carried Over to the Next Year (E) | – | 2,000,000 |

| 2023 Corporate Tax Base (F) | 1,000,000 | – |

| 2023 Investment Obligation Amount (G=D*%3) | 60,000 | – |

The table structure remains intact, and the text content has been translated into English.

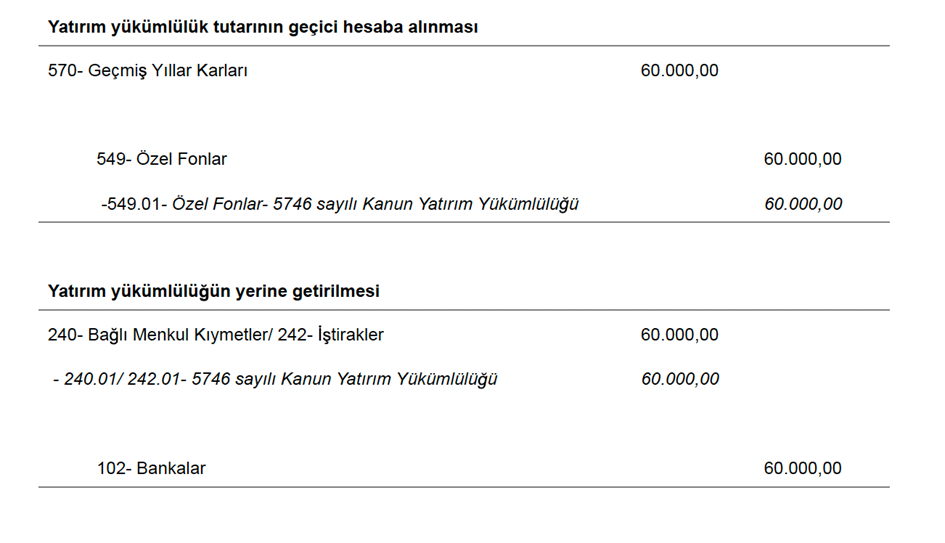

Accounting Records

(A) Ltd. Şti., which owns an R&D/Design Center, will pay annual corporate tax for the year 2023.

R&D and design deduction amounting to TL 2.000.000 over the declaration of the corporation

deducted from its income. In this context, 3% of the business

(60.000=2.000.000*3%) journal entries for the investment liability are as follows

it will be like this.

¹Adana Tax Office Directorate dated 02.05.2023 and E-19341373-125[SPECIALIZATION-2022/16]-44120

numbered Special Decision, it is stated that corporate taxpayers who own a Design Center may also invest in this investment.

is subject to the obligation.

BİLGENER