Is it possible to apply reduced tax on export earnings in the event of a financial profit due to PPEs in companies with a commercial balance sheet loss?

A. General Principles of Reduced Tax Application to Export Activities

According to Article 30 of the Corporate Tax Law, the corporate tax rate is reduced by 5 percentage points for the export earnings of exporting companies.

When applying the export deduction, after each income item is determined separately, KKEGs are added to the taxpayer’s commercial balance sheet profit / loss, deductions, exemptions and previous year losses are deducted and the final amount is reached.

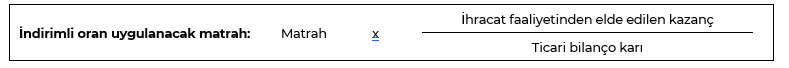

In the event that taxpayers have earnings from other activities in addition to export activities, the tax base arising from exports to be deducted is determined by proportioning the earnings from exports to the commercial balance sheet profit:

B. Commercial Balance Sheet Profit is Higher than Export Profit

Trade balance sheet profit may be higher or lower than export earnings.

In cases where the commercial balance sheet profit is equal to or less than the export profit, reduced tax is applied to the entire export profit, provided that it does not exceed the net corporate income. However, when the commercial balance sheet profit is higher than the export profit, it is necessary to find the portion corresponding to the export profit in the tax base by making this proportion.

The example in the Corporate Tax General Communiqué Serial No. 1 on the subject:

“Example 5: (E) A.Ş., which operates in the field of telecommunications in Turkey, also provides roaming services within the scope of the agreements it has made with the operators of the relevant country in order for foreign users to benefit from telephone services in Turkey with their mobile lines purchased in their own countries. In this context, in 2022, customers of telecommunication companies resident in various countries used telephone roaming services in Turkey.

Information on the operating results of (E) A.Ş. for 2022 is as follows.

Commercial balance sheet profit …………………………………………………………………………………………………………. : 50.000.000 TL

– Earnings from export activities …………………………………………………………………….. : 5.000.000 TL

(Profit from roaming services)

-Other gains (not covered by the 1 percentage point deduction)………………………………………………….. : 45.000.000 TL

KKEG …………………………………………………………………………………………………………………………… : 2.000.000 TL

Exemption for gain on sale of immovable property …………………………………………………………………………………….. : 12.000.000 TL

Matrah ……………………………………………………………………………………………………………………….. : 40.000.000 TL

(E) A.Ş.’s tax base to which 1 point discount will be applied due to the income obtained from export (circulation / roaming service) activity in 2022 will be determined as follows.

The base to which the reduced rate will be applied: Base x (Earnings from export activity / TBK)

: 40.000.000 TL x (5.000.000/50.000.000)

: 40.000.000 TL x %10

: 4.000.000 TL

Therefore, (E) A.Ş. will apply a discounted corporate tax rate to 4.000.000 TL of the base of 40.000.000 TL for the year 2022, and the general rate will be applied to the remaining 36.000.000 TL of the base.”

C. Commercial Balance Sheet Profit Less than Export Profit

As mentioned above, from time to time, earnings from export activities may be higher than the commercial balance sheet profit.In such cases provided that it does not exceed the net corporate income 5 points discount can be applied to the entire earnings from export activities.

Example in the Communiqué on the subject:

“Example 3: (Ç) A.Ş., which is engaged in export activities, earned TL 600.000 from this activity in 2022, but its other activities that are not within the scope of 1 point deduction resulted in loss. Information on the operating results of (Ç) A.Ş. in 2022 is as follows.

Commercial balance sheet profit …………………………………………………………………………………………………………. : 500.000 TL

-Earnings from export activities …………………………………………………………………….. : 600.000 TL

-Other loss……………………………………………………………………………………………………………….. : 100.000 TL

KKEG …………………………………………………………………………………………………………………………… : 300.000 TL

Matrah ……………………………………………………………………………………………………………………….. : 800.000 TL

Since (Ç) A.Ş.’s earnings from export activity in 2022 (600.000 TL) is more than the taxpayer’s commercial balance sheet profit (500.000 TL), the corporate tax rate will be applied with a 1 point discount to the entire earnings from export activity (600.000 TL), provided that it does not exceed the pure corporate income.”

In the example, the commercial balance sheet profit is lower than the export profit. As can be seen, in this case, the formula is not applied and reduced tax is applied to the entire export profit. It should be noted that although the commercial balance sheet profit is 500.000,00-TL, reduced tax is applied for the 600.000,00-TL portion. This situation Even if it is caused by PPE shows that a reduced tax can be applied to a higher tax base than the commercial balance sheet profit.

If the tax base is lower than the export earnings provided that it does not exceed the tax base reduced tax will still be applicable.

D. Export Deduction in case of Loss on Trade Balance Sheet

The Communiqué only gives examples of situations where there is a commercial balance sheet profit. This means that in cases where there is a loss on the commercial balance sheet but there is a financial profit due to PPEs, reduced tax is applied to export earnings. cannot be applied to think about it. However, just as in the example given above, reduced tax can be applied to export earnings that are higher than the commercial balance sheet profit, in the same situation in the event of a financial profit after a loss on the commercial balance sheet must also be valid.

We can concretize the issue with the following example:

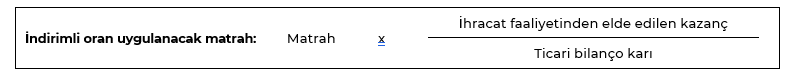

Information on the operating results of Entity A for the 2023 accounting period is as follows:

Loss on trade balance sheet……….5.000.000 TL

- Export earnings…10.000.000 TL

- Other operating loss………15.000.000 TL

KKEG………………………….7.500.000 TL

KV Matrahı…………………..2.500.000 TL

As can be seen, the taxpayer has incurred a loss as a result of other activities, but has made a profit from export activities. After the addition of KKEG, the final corporate tax base is formed.

In this case, reduced tax should be applied to earnings from export activities, provided that they do not exceed the fiscal profit.

This is because, although there is a loss in the commercial balance sheet, there is also a gain arising from exports in the formation of the final tax base. Without this gain, the tax base would not have been formed or would have been lower even if KKEG was added. In our opinion, in the example given in the previous section, this is the reason behind the application of reduced tax on a portion of the tax base due to the KKEG.

D. Disclosure of the Deducted Base in the Declaration

Loss, export gain and reduced tax are shown in the declaration by following the steps below:

First, the loss and PPE is reflected in the declaration as follows. Here, not the part of the export gain to be taxed at a reduced rate all of it must be shown.

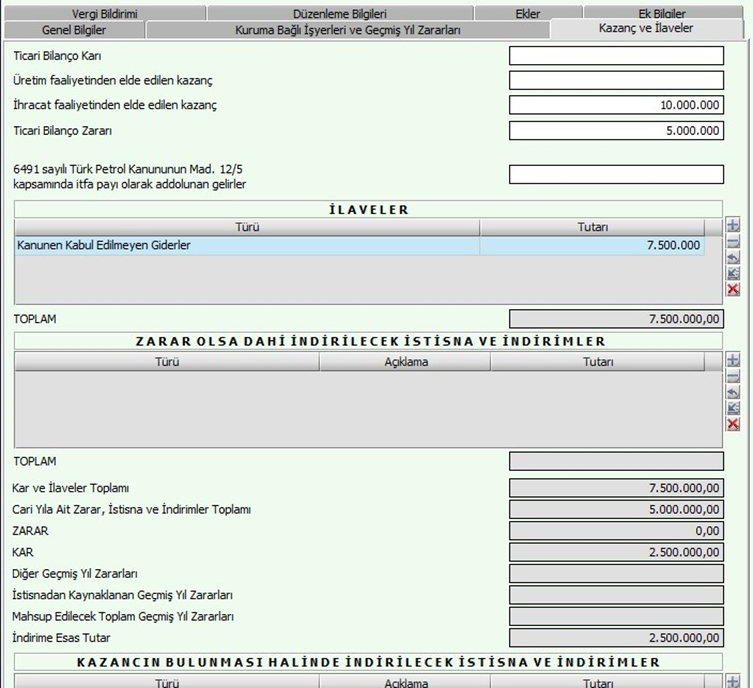

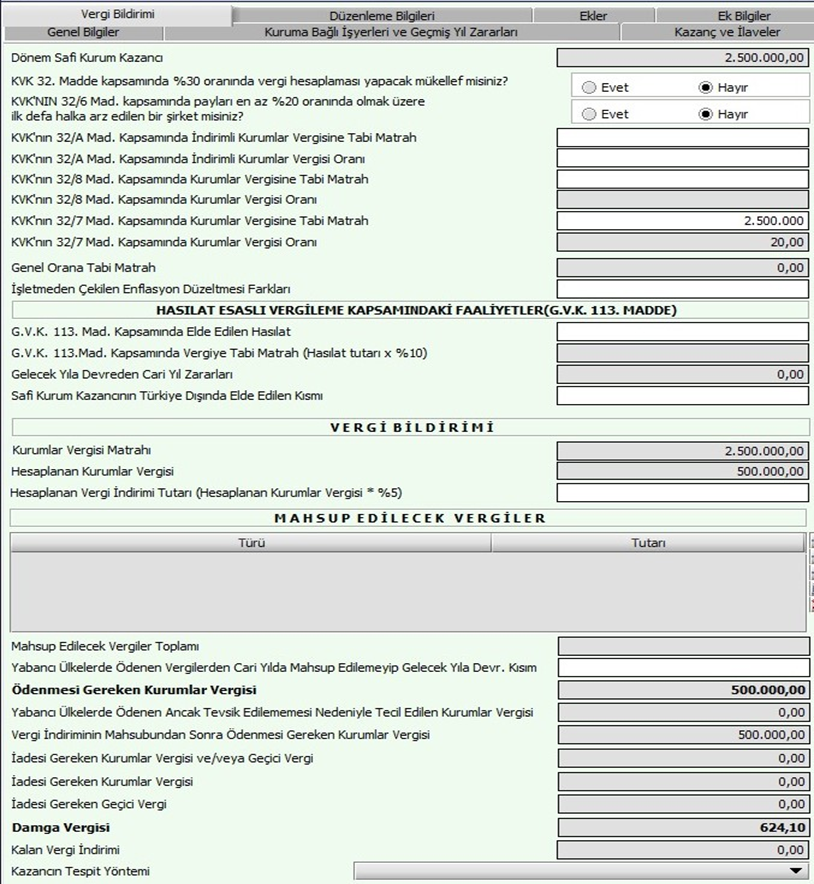

Afterwards, the net corporate income of TL 2.500.000,00 is declared within the scope of export earnings and 20% tax is calculated over it:

Although the taxpayer has a commercial balance sheet loss, reduced tax is applied to the income obtained from exports not exceeding the pure corporate income.

On the other hand, in the event that earnings are also obtained from manufacturing activities, it is possible to apply reduced tax to the tax base according to the ratio of the total earnings obtained from manufacturing and exports separately.

BİLGENER